Latest posts

A masterclass in creating value

What’s going on at parkrun?

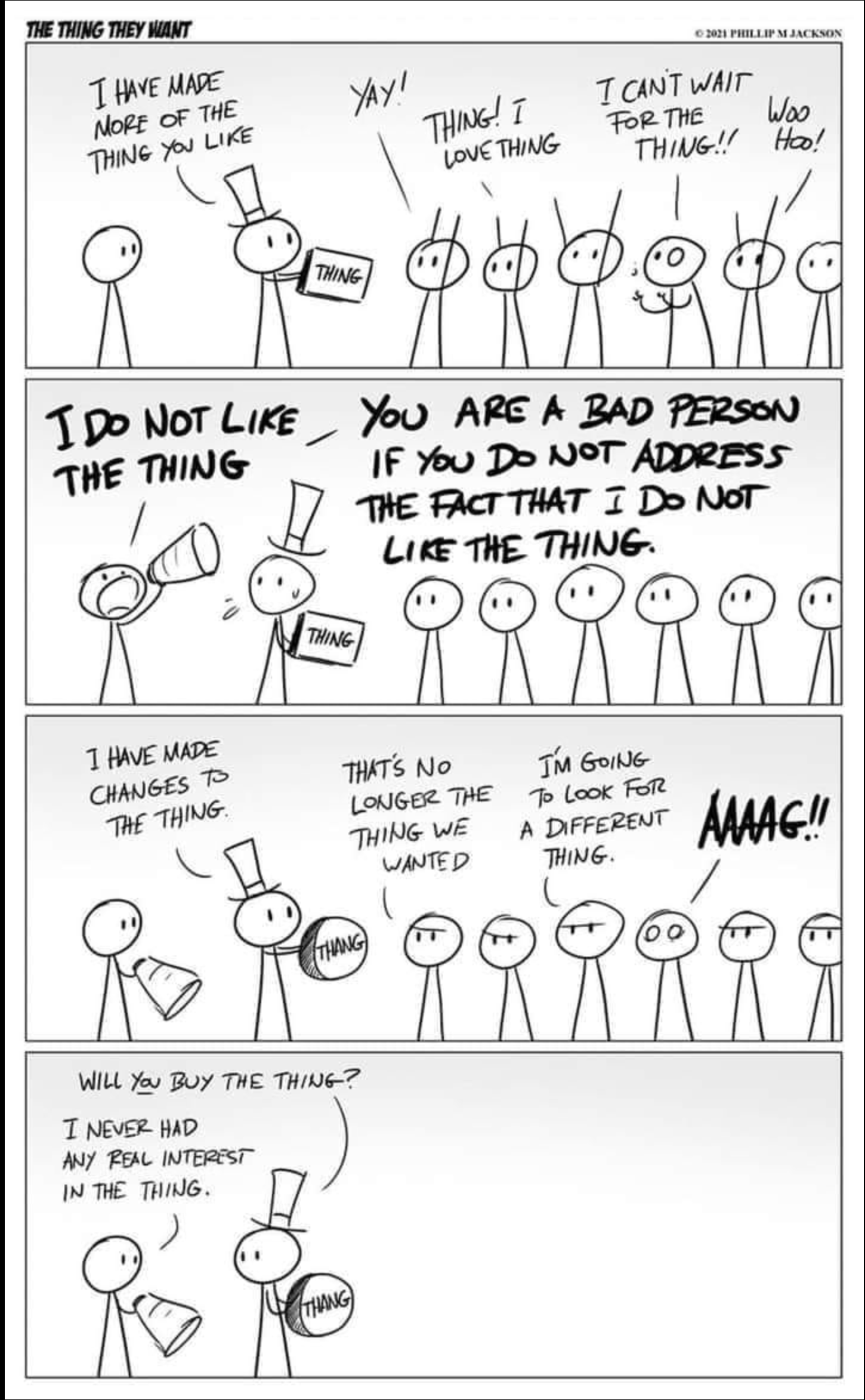

Virtue-signalling all the way to the bank

Bud Light: brand purpose or virtue-signalling?

The Coddling of the American Mind, by Greg Lukianoff and Jonathan Haidt

Belonging, by Owen Eastwood

Such a simple thing

The Long Win, and The Scout Mindset

The Cult of We by Eliot Brown and Maureen Farrell

Coffee and covid modelling

By theme

Marketing strategy

Insight & metrics

Innovation & inspiration

Brand & positioning

Marketing communications

Business purpose

Leadership

By industry sector

Financial services

Retail

FMCG

Technology & start-ups

Consumer services

Business to business

Other sectors

By type

Books

Comment

Quotes

Thought leadership

Two million dollars. That’s how much Paul Allen, co-founder of Microsoft, paid for Jimi Hendrix’s Fender Stratocaster, the one he played at Woodstock. Anyone can buy a Fender Stratocaster for around £1000, but only one person can have that one.

It’s not surprising then that replica guitars are good business. Guitar brand Gibson have made replicas of legendary Led Zeppelin Jimmy Page’s favourite guitars, and charged a premium for the first 50, each signed by the man himself. Read More

Parkrun’s growth has been phenomenal. Their mission is “to transform health & happiness by empowering people to come together, to be active, social & outdoors.” They want to reach more people. Commendable. They say critics don’t understand parkrun – it’s a community event not a race, they tell us. They see inactive or socially isolated people as the ones who need parkrun most. So it is important that people don’t fear that they will be too slow or will feel unwelcome. Read More

The recent travails of NatWest bank show what happens when the ESG agenda strays beyond being a good citizen into social engineering. Their practices seem to have included vetting and sacking long-standing customers whose political views were judged unpalatable. Who decided which views, and who did the judging, we may never know. It is likely, though, that this drive to cleanse their customer base of certain political positions is not limited to one customer or one bank. Read More

Bud Light is in the news for a small social media marketing activity which has had a spectacular impact, both large and rapid. It went viral, amplified all over social media and generating massive visibility and awareness. Every marketer’s dream in other words. Except that this one drove sales down. The decision to celebrate transgender influencer Dylan Mulvaney’s 365 “days of womanhood” led to a 26% fall in sales in a matter of days. Read More

When and how did we all become so emotionally fragile? One might accept that children should be protected from old-fashioned books which might teach them wrong or outmoded ideas, as per the recent furore over the revision of Roald Dahl’s classic children’s books. (Or not.) But a trigger warning for university students on Jane Austen? This book will help you trace the origins of this extreme sensitivity. Of course it comes from the USA, Read More

In Owen Eastwood’s book, Belonging, there’s a chapter about the South Africa cricket team after the end of apartheid. It’s worth reading this book for that chapter alone. One result was that they changed their name from the Springboks to the Proteas. But of course, a name change without real change is nothing. Eastwood was there when the real change happened, and it’s spine-tingling.

I say this because there’s a lot of Maori legend and new-agey type stuff early on in the book, Read More

Look. Until now I always had to turn the cheese block sideways to grate it, then turn it back to slide it back into the packet. I will now buy this cheese because they’ve solved that tiny problem. It’s not the result of some genius invention or astonishing insight, just simple observation. Little things can make a difference. Read More

The Long Win, by Cath Bishop

The Scout Mindset, by Julia Galef

“Can I give you some feedback?” If those words make your stomach churn, or your heart sink, then Cath Bishop’s book is for you. The Long Win, subtitled The Search for a Better Way to Succeed”, can show us how to make the most of every learning opportunity, so that you can win even when you lose. We see how this can work in sport, Read More

This is a story of monumental hubris, greed and failure. The account of how the charismatic founder of WeWork, Adam Neumann, and his wife, Rebekah, drove the business into near-bankruptcy while extracting a billion dollars for themselves is a good read. The greed is not just theirs, though their hypocrisy is at times breath-taking. “We believe in this new Asset Light lifestyle” says Rebekah, after buying a $15m estate in Westchester, New York. This was not their first home; Read More

External changes force people to change their habits, presenting both risk and opportunity. Pret A Manger’s monthly coffee subscription was launched in autumn 2020, aimed at restoring footfall post-pandemic. It doesn’t cost much to give hot drinks away; the price is mostly margin. Since the average customer buys five coffees a week, £20 a month for all the drinks you want is great value, and should drive loyalty, re-establishing the coffee habit as a Pret habit. Read More

Latest posts

A masterclass in creating value

What’s going on at parkrun?

Virtue-signalling all the way to the bank

Bud Light: brand purpose or virtue-signalling?

The Coddling of the American Mind, by Greg Lukianoff and Jonathan Haidt

Belonging, by Owen Eastwood

Such a simple thing

The Long Win, and The Scout Mindset

The Cult of We by Eliot Brown and Maureen Farrell

Coffee and covid modelling

By theme

Marketing strategy

Insight & metrics

Innovation & inspiration

Brand & positioning

Marketing communications

Business purpose

Leadership

By industry sector

Financial services

Retail

FMCG

Technology & start-ups

Consumer services

Business to business

Other sectors

By type

Books

Comment

Quotes

Thought leadership